“Karma Yoga”

“"Continue to perform your duties without expecting results. Do good, and good will come back."“

- Healer Baskar

Anatomic Therapy Foundation is dedicated to helping you live a better life. As a volunteer-based non-profit organization, we are proud to have a team of service-oriented staff who work with great dedication and joy. It is our responsibility to support them financially, ensuring they can continue their valuable work.

Since we provide most of our courses, meals, and accommodations free of charge, we rely on your financial assistance to sustain our efforts. Your contributions enable us to carry out our mission more effectively.

Please help us by completing the donation form below. Your support allows us to serve you better.

Thank you for your generosity.

Offline Contribute

-

dd and cheque

You can donate through cheque or DD using the given address.

Name: Anatomic Therapy Foundation

No x-172 North Housing Unit, Perur Main Road.

Selvapuram, Coimbatore - 641026. Tamilnadu - India -

Account Number

Name: Anatomic Therapy Foundation

Bank: State Bank of India

A/c No. 33618417146

Branch - Kovaipudur Branch, Coimbatore. Tamilnadu - India.

IFSC Code: SBIN0015472 -

ECS

Not only between a husband and a wife, for any relationship that involves...

-

Non - Cash

We truly appreciate any kind of contribution. Apart from cash donation, you may also consider a few other ways of contributing like providing grocery, provision, seating, audio and video requirements or water which are some of our essentials for the programs and courses that we offer.

Online Donation

BANU HOME EDUCATION

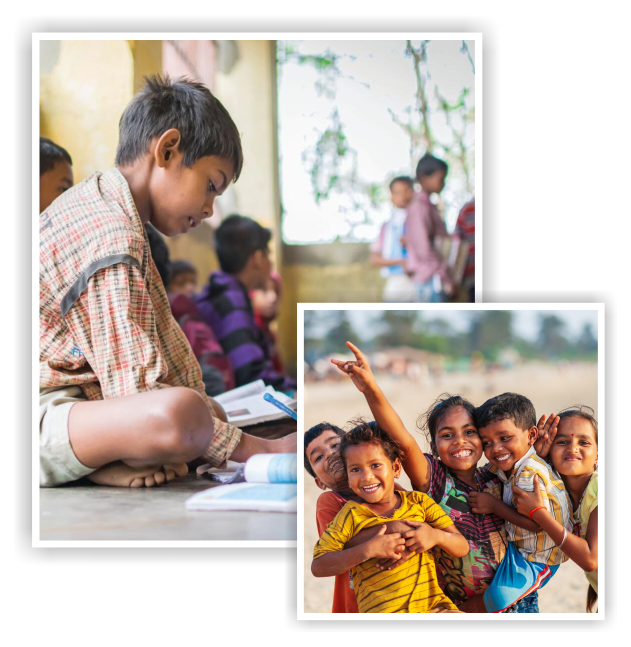

Banu Home Education System, developed by Healer Baskar, is an innovative approach to education. Currently, 50 children are enrolled in this system, receiving training designed to foster holistic development and lifelong learning. It is our collective duty to ensure that both present and future generations receive a high-quality education that equip th with necessary life-skills. By contributing your skills and resources, you can support and enhance this pioneering educational initiative.

Read More

good soul good vipe

good soul good vipe -

Read More

Children's

Vestibulum imperdiet nibh vel magna lacinia ultrices. Sed id interdum urna. Nam ac elit a ante commodo tristique. Duis lacus urna, condimen tum a vehiculaa. Vestibulum imperdiet nibh vel magna lacinia ultrices. Sed id interdum urna. Nam ac elit a ante commodo tristique. Duis lacus urna, condimen tum a vehiculaa. Read More

Blood Donation

Donation Form

Fill The Form

Thank For Donation

"Making a Difference Together"

Donors are the cornerstone of our Foundation’s mission to enhance the growth and well-being of humanity and unearth timeless traditional wisdom. Every contribution helps us uncover and promote the natural and universal justice that often goes unnoticed.

Thank you to all our donors for your unwavering financial support.